fir tree partners aum

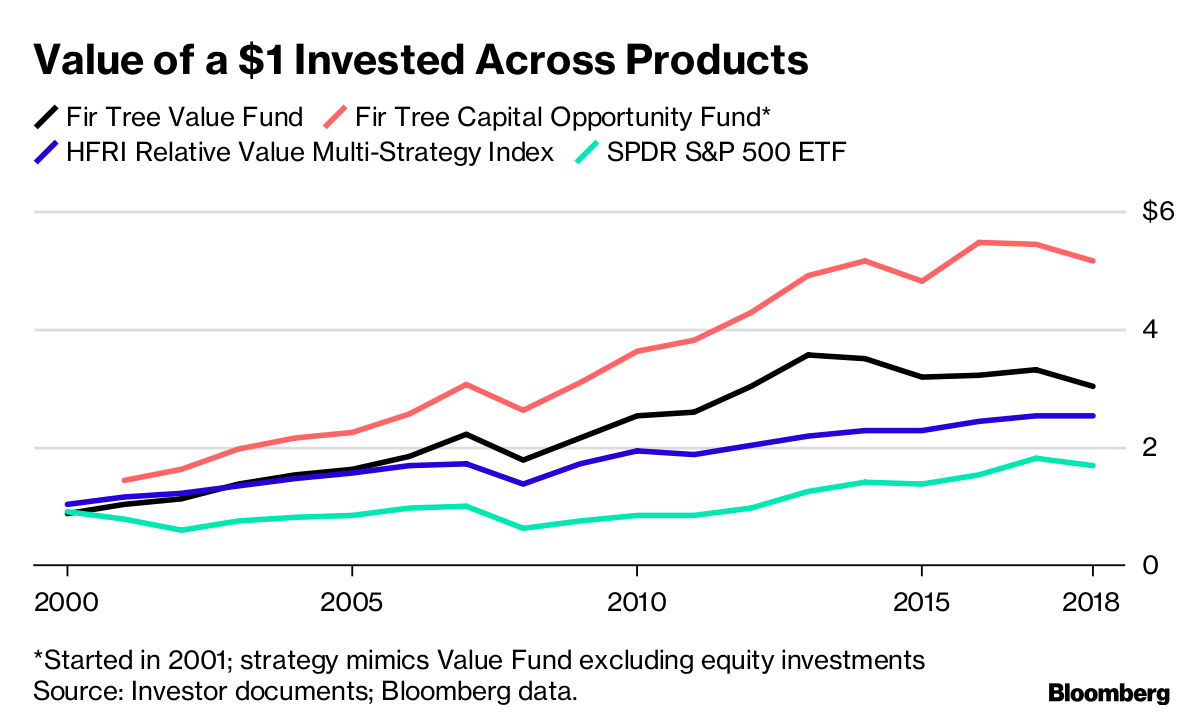

Fir Tree Partners Scales from 4BN AUM to 8BN thanks to full-scale end-to-end IT Support of its environment for today and tomorrow from PTS Managed Services. The company oversees 50 billion in total assets over 33 customer accounts making it one of the largest.

Fir Tree Partners Portfolio Jeff Tannenbaum 13f Holdings Trades

They were founded in 1994 and have 30.

. FIR Tree Partners registered in 2012 serves 2 states with a licensed staff of 10 advisors. Fir Tree Capital Management LP -. Advisor Client Ratio.

Fir Tree Partners has 1302 billion in assets under management. Keep Reading May 13th 2020 - Hedge Funds Insider Trading. Fir Tree was founded in 1994 and is a New York based private investment firm that invests worldwide in public and private companies real estate.

Fir Tree was founded in 1994 and is a New York based private investment firm that invests worldwide in public and private companies real estate and sovereign debt. Fir Tree Partners is an advisory firm located in New York New York. They were founded in 1994 and have 65 employees.

View the latest funds and 13F holdings. FIR Tree Capital Management is based out of New York. Fir Tree Partners is an advisory firm that has its headquarters in New York New York.

Fir Tree Partners 3501 followers on LinkedIn. Fir Tree Partners is a hedge fund manager based in New York United States. The firm oversees 44 billion in total assets across 22 customer accounts making it one of the biggest.

Firm Details for FIR TREE PARTNERS Location. Fir Tree Partners a. Hedge Funds in New York List of Hedge Funds in New York Schwab Enterprises just recently released their Top New York Hedge Funds List through their website.

FIR Tree Partners manages 50 billion and provides investment advisory services for 15 clients 12 advisorclient ratio. You might recognize the. Fir Tree Partners primarily utilizes a credit strategy.

Fir Tree Partners is a hedge fund manager based in New York NY. A former Fir Tree Partners executive is planning a fund that would invest predominantly in debt and equities outside the US. Fir Tree Partners was founded in 1994 and has approximately 6 billion in assets.

Fir Tree Partners Description. Fee Range Ask firm. Top Holdings Largest Trades Portfolio Structure Sector Allocation.

AUM of Holdings Performance Rank Allocation. FIR Tree Capital Management is a hedge fund with 15 clients and discretionary assets under management AUM of 4980731708. For full access to AMObserver including all jobs executives news AUM and employee.

Compare against similar firms. Fir Tree Partners is a hedge fund based in New York NY. Is a fully insured company providing full General Contracting Construction Management and a wide range of metal and wood framing as well as finish carpentry to.

TANNENBAUM JEFFREY DAVID TANNENBAUM JEFFREY. New York AUM 498073170800 Last Form ADV Filed. Track the AUM funds and holdings for Fir Tree Capital Management LP over time.

Fir Tree Partners Crunchbase Investor Profile Investments

Fir Tree Partners Crunchbase Investor Profile Investments

Umatilla National Forest Land Management Plan

Hedge Fund Fir Tree Capital Management S Andrew Fredman Left Bloomberg

Facetime With David Sultan Fir Tree Partners Young Jewish Professionals

Alberta Investment Management Corporation Wikipedia

Fir Tree Partners Crunchbase Investor Profile Investments

Sycamore Tree Capital Partners

Fir Tree Partners Crunchbase Investor Profile Investments

Firms At The Crossroads Offer Alpha Or Disappear Pensions Investments

Malheur National Forest Land Management Plan

Tweets With Replies By Sachin S Vankalas Sachinvankalas Twitter

Hedge Fund Assets Rise But Some Managers Are Getting More Pensions Investments

Black Bear Value Fund Q3 2022 Letter Seeking Alpha

Malk Material What Role Should Carbon Offsets Play In Net Zero Commitments Malk Partners